does unemployment reduce tax refund

Reporting unemployment benefits on your tax return. If you received unemployment benefits last year and filed your 2020 tax return relatively early you may find a check in your mailbox soon.

Unemployment Tax Refund Update What Is Irs Treas 310 Abc10 Com

When it went into effect on March 11 2021 the American Rescue Plan Act ARPA gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020.

. Receiving unemployment benefits does not mean that a federal income tax refund will be reduced. You probably didnt have taxes withheld on your unemployment benefits. Note the Delete Form button at the bottom of the screen.

Depending on the taxpayers original return the exclusion should be reported in accordance with the following instructions. A tax refund which occurs when a tax filer overpays their federal income. What are the unemployment tax refunds.

This is probably where your return was affected the most. Why does my unemployment 1099-g lower my refund by 50. Self Employed Tax Preparation Printables Instant Download Etsy Tax Preparation Tax Checklist Tax Prep What To Expect When You Call The Irs And How To Prepare In 2021 Tax Help Irs Tax Refund.

You report your unemployment compensation on Schedule 1 of your federal tax return in the Additional Income section. The amount will be carried to the main Form 1040. This information is not available from the.

When I put in my 1099g my refund goes down by close to 50 - thats a lotwhy is that. That May Reduce EITC Refunds Next Spring. Does unemployment reduce tax refund Sunday March 6 2022 Edit.

While taxes had been waived on up to 10200 received in unemployment for those making less than 150000 in 2020 -- the first year of the pandemic -- that was only temporary relief and no such. How does unemployment affect your tax refund. Remember to keep all of your forms including any 1099-G form you receive with your tax records.

President Joe Biden announced in March that the federal government would not tax the first 10200 of unemployment benefits for taxpayers earning less than 150000 in 2020. Forms you receive When you have unemployment income your state will send you Form 1099-G at the end of January. Do not reduce this amount by the amount of unemployment compensation you may be able to exclude.

You had to qualify for the exclusion with a modified adjusted gross income MAGI of less than 150000. It increases your taxable income. Despite stimulus money not being taxable you may notice that if you got that money already it may appear to reduce your tax refund.

If you havent paid enough in taxes you may end up owing taxes when you file your return. This means you dont have to pay tax on unemployment compensation of up to 10200 on your 2020 tax return only. I received about 5K in unemployment benefits this year and then got a full-time job and I ended up in the 25 bracket.

Unemployment Benefits Are Taxable Income. The first 10200 of 2020 jobless benefits or 20400 for married couples filing jointly was made nontaxable income by the American Rescue Plan in March. It can have a negative impact on the Earned Income Credit EIC.

If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan Act enacted on March 11 2021 allows you to exclude from income up to 10200 of unemployment compensation paid in 2020. Unemployment compensation is not considered earned income for the Earned Income Tax Credit EITC childcare credit and the Additional Child Tax Credit calculations and can reduce the amount of credits you may have traditionally received. With The Latest Batch Uncle Sam Has Now Sent Tax Refunds To Over 11 Million Americans For The 10200 Unemployment Compensation Tax Exemption.

Go to Tax Tools on the left and navigate to Tools-Delete a form. Since May the IRS has been making adjustments on 2020 tax returns and issuing refunds averaging around 1600 to those who can claim an unemployment tax break. Youll use this form to complete your 2020 tax.

If youve paid too much during the year youll get money back as a tax refund. If Your Time is short. The refund you received from your 2020 federal tax return this includes any additional federal refund received as a result of an adjustment made on your 2020 return to exclude 10200 of unemployment compensation.

Delete form s 1099-SA if one 8889-T and 8889-S if one. Add lines 1 2 and 3. Many low- and moderate-income households no doubt were assisted greatly by enhanced federal Unemployment Insurance benefits that they received earlier this year and would be thrilled to receive a second roundif Congress and President Trump ever agree on a new pandemic.

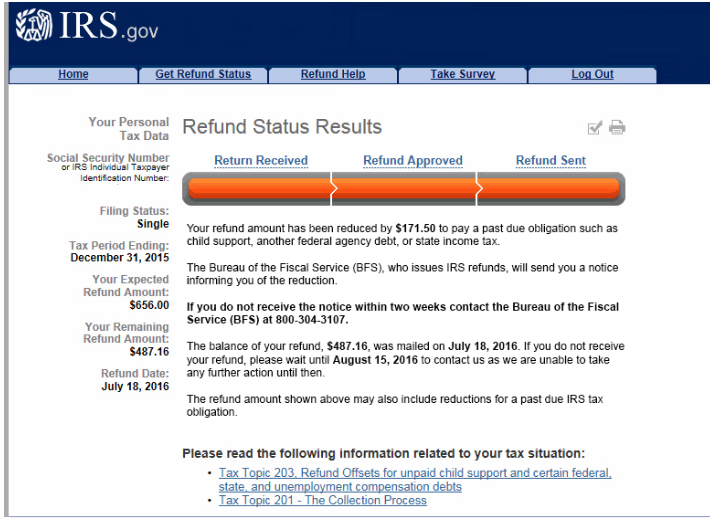

CPA Aradhana Aggarwal who has an. An amended return reporting the unemployment exclusion will allow many taxpayers to receive an additional tax refund and allow for some other taxpayers to reduce a scheduled tax payment. If the refund is offset to pay unpaid debts a notice will be sent to inform you of the offset.

Unpaid debts include past-due federal tax state income tax state unemployment compensation debts child support spousal support or certain federal nontax debts such as student loans. To find the amount you received check your records or call the IRS at 800-829-1040. Go to View at the top choose Forms and select the desired form.

The exemption which applied to federal taxes meant that unemployment checks sent during the pandemic werent counted as earned income. The American Rescue Plan Act which was signed on March 11 included a 10200 tax exemption for 2020 unemployment benefits. Unemployment benefits are taxable.

If you are filing Form 1040 or 1040-SR enter the amount from line 10c. If someone properly claimed unemployment benefits and overpaid the taxes on them the resulting refund could be reduced to satisfy unpaid government debt or unpaid child support she said. Adding 1099G Unemployment Compensation can cause your refund to go down for a couple of reasons.

New York which has the second highest unemployment rate in the country is one of just 11 states that is fully taxing unemployment benefits according to HR Block.

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Avoid 6 Mistakes That Will Delay Your Irs Tax Refund

Unemployement Benefits Will I Get A Tax Refund For This Benefit Marca

Waiting For A Tax Refund 9 Biggest Reasons Why Your Irs Money Could Be Late Cnet

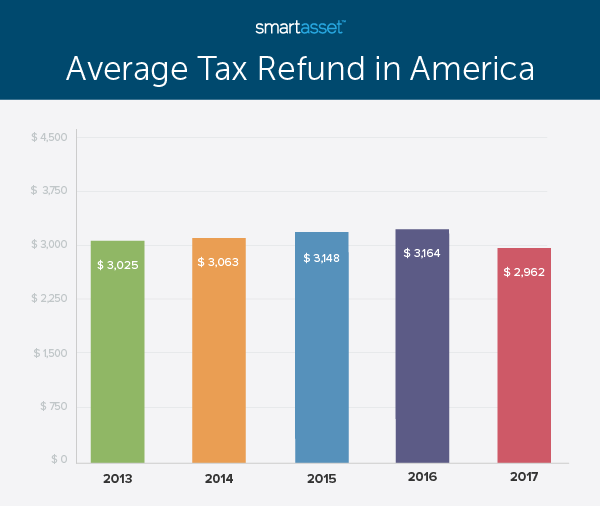

Average Tax Refund Up 11 In 2021

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Stop Stealing Our Income Tax Refunds Because Of Student Loans

Will Tax Refunds Be Lower This Year For Americans As Com

The Democratic Republic Of Congo S Weapon Against Ebola Entrepreneurship Registeronline Congo S New Presi Business Tax Accounting Services Income Tax Return

Topic No 203 Refund Offsets For Unpaid Child Support Certain Federal And State Debts And Unemployment Compensatio Internal Revenue Service Tax Refund Topics

Here S The Average Irs Tax Refund Amount By State

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Tax Refunds In America And Their Financial Cost 2020 Edition Smartasset

Fikr12 The 12th Annual Arab Thought Foundation Conference Under The Theme A Road Map For Job Creation 80 Million Job Marketing Jobs Online Jobs Job Opening

Irs Announces More Than 1 5 Billion Of Unclaimed Tax Refunds For 2016 Tax Year The Irs Announced That More Than 1 5 Billi Tax Attorney Paid Leave Tax Refund

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor